I have an important topic to talk to you about today:

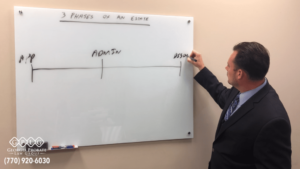

The three phases that every estate goes through in the Georgia probate process.

After reading about these phases, you’ll have an overview of the steps to probate a will in Georgia, from the beginning when we open the estate, to the end when we’ve closed the estate because everything has been settled and finished.

Here are the three phases that we’ll cover:

- The appointment phase.

- The administration phase.

- The distribution and discharge phase

The Appointment Phase

In the appointment phase, our main goal is to get someone acquainted who’s able to represent the estate, and act on behalf of the estate.

If there’s a will, this person is called an executor. If there’s not a will, they are called an administrator.

To get that person appointed, we’ll need to file a petition with the probate court.

That petition is going to have a number of disclosures that we have to make, and we may need to file some additional attachments with it.

In this first phase, there are three things that I’m primarily concerned about where we can make a difference in how the overall estate process goes, how expensive it is, and how involved it is, and how long it takes.

- Are we required to file a bond?

- Are we required to file inventories?

- Are we going to have expanded powers, or are we going to have limited powers For our executor and our administrator?

If we have to file a bond, if we have to file inventories, if we have limited powers, that means that this process is going to be more expensive, and it’s going to take longer, and it’s going to be more involved, because we’re going to have to be going to court more frequently.

If, on the other hand, we’re able to waive bond, we’re able to waive inventories, and we’re able to get expanded powers, that means the process is going to take less time, be less involved, and less expensive, because we only have to go to court once at the beginning to open the estate, and once at the end to close the estate. (We don’t have to file a tedious inventory or go pay for a bond.)

If everyone’s on the same page, that’s the way we prefer to do it.

We filed our petition.

We either have asked for those waivers or we haven’t, and now we’ve gotten a document back from the court called letters testamentary, or letters of administration.

That’s actually a court order that gives our executor or our administrator the power to act.

Quick note: Before you get that order, no one has the authority to act on behalf of the estate, so please don’t go and try to start doing things before then. That’s how folks sometimes find themselves in trouble.

Once we get that document back, we’re ready to move to the second phase. That second phase is called the administration phase.

The Administration Phase

In the administration phase, we are primarily concerned with settling the estate.

That’s where we do the work of the estate, that most people think of as “settling the affairs”.

That’s where we make a decision about whether we’re going to keep property or sell property. That’s where we figure out who does the estate owe money to? We have to make sure that those creditors get paid, or otherwise otherwise addressed.

We also figure out who’s going to get what in the end. Under the terms of the will, who does the will identify is supposed to inherit property, or if there is no will, under state law, who are the heirs that are supposed to inherit property?

One tricky thing that often comes up in this phase is the idea of whether or not we’re going to sell property.

Sometimes you can be forced to sell property if there’s not enough cash in the estate to pay the debts.

That typically comes up in a situation where we could be forced to sell the estate home. Oftentimes, families may not want to do that, so there are ways around that, but I want to highlight that as a potential issue to be aware of.

In the second phase, we’re going and we’re working with the property, we’re selling the property, we’ve paid the creditors, and now we’re at the point of making a distribution to the family members. Making their inheritance distribution to them.

Once we’re ready to do that, we’re now finished with the second phase, and we’re ready to move to the third phase.

The Distribution & Discharge Phase

The third phase we call distribution and discharge.

In the distribution and discharge phase, our main goal is to close the estate.

There’s a few things we’re going to do:

- We’re going to confirm that we’ve calculated the distributions correctly.

- We’re going to confirm that any kind of executors fee, or administrators fee, has been calculated correctly.

- We’re going to make sure we’ve paid all the creditors, then we’re going to make those distributions.

Then, our attention turns to closing the estate.

Why?

Because at this point, most of the time our executor or our administrator is primarily concerned with how to finish the estate, and also to not have to look over their shoulder in case anything happened, or didn’t happen correctly.

Georgia law provides two ways to close an estate.

- We ask the court to simply close the estate.

- We ask the court to close the estate and put a liability shield up, protecting our executor, or our administrator.

We want to use the second way.

There’s a number of disclosures that have to be made when we file this petition.

We want to make sure that we make those disclosures correctly because if we don’t, it could put our liability shield at risk and make it ineffective.

Summary:

We start by getting someone appointed.

Then we move to settling the estate.

Then we move to closing the estate.

When it comes to probating a will in Georgia, feel free to call our office at (770) 920-6030. We’d be happy to have a consultation with you and answer any questions you have about your unique situation.

Disclaimer: The information above is provided for general information only and should not be considered legal advice. Our probate attorneys provide legal advice to our clients after talking about the specific circumstances of the client’s situation. Our law firm cannot give you legal advice unless we understand your situation by talking with you. Please contact our law office to receive specific information about your situation.