So, you’ve recently learned that a deceased loved one had named you the executor of estate on their will — Now what?

Before you accept the role, you must be aware of the responsibility that goes with it, including having a thorough understanding of probate laws.

You can easily be held personally liable without the necessary legal knowledge to guide your actions.

We recommend having an attorney in your corner as you move through the probate process to ensure all steps conform with the law.

In the meantime, we’ll cover your most common questions in this article.

What Is an Executor of Estate?

When a deceased person leaves a will, the document should identify one person to act on behalf of the estate. This person is what we call the executor of estate.

The decedent typically designates someone — their surviving spouse, a family member, a lawyer, or any person they consider qualified to fulfil their final wishes.

Should the nominated person accept the role, they will be responsible for estate administration, paying all the estate’s debts before distributing assets to the beneficiaries.

An executor’s job also includes legally and correctly enforcing the will throughout the probate process.

Without a will, the Probate Judge must designate another person called an administrator to take over the same responsibilities.

Can an Estate Executor Decline Their Role?

A designated executor of estate after death may decline if they consider themselves unable to carry out their responsibilities.

If they had previously accepted the position, they must seek the court’s permission to resign while providing a reasonable justification.

Once their request is granted, the court may look to the will to verify if any Successor Executors are named to serve as executor of estate. Those individuals will be asked to serve. If the Successor Executors are unable or unwilling to serve, then the court may nominate someone else (an administrator) to manage the deceased person’s estate.

How Does the Probate Court Appoint an Executor of Estate?

Although the decedent’s last will already names an executor of the estate, this person still has no legal authority to act.

The court needs to officially appoint them first before they carry out the deceased’s wishes.

One of the first steps in the probate process is to submit the decedent’s will and a formal request to let the nominated person serve. Along with these documents, they must also file a duly filled petition.

It’s best to work with a probate attorney when filing these requirements to ensure that everything is compliant.

Once the court approves the petition and if all heirs agree to the will, the probate court will approve it, and the named executor of the estate will receive an order that officially appoints them to the position.

This legal document, called Letters of Testamentary, gives the individual authority to take charge of the deceased person’s probate assets.

The Powers of an Executor of Estate

Certain powers are granted to executors by default, and these are outlined in the will and the court order issued to them.

Unfortunately, there is no guarantee that the powers outlined in the will are sufficient to complete everything that is necessary.

Personal representatives may need to obtain expanded powers to accomplish more tasks in a shorter time, but Georgia Law won’t automatically grant these to anyone.

If you’re in this situation, there are ways to obtain expanded powers so you can expedite the process:

Scenario 1: If the decedent left a will

You will have to check if the document gives you additional authority beyond the default powers under Georgia Law.

It is common for a will to list specific actions you’re allowed to take or reference a code section from Georgia Law that contains a long list of additional powers for an executor of estate.

Scenario 2: If the will does not specify anything

Heirs must unanimously consent to give you expanded powers for the court to approve.

Scenario 3: If there is no will at all

You will also need formal consent from all heirs to obtain expanded powers.

In both cases, the Probate Judge may honor or deny the request, but it is more favorable when everyone is on board.

Do Estate Executors Receive Any Compensation? Executor of Estate Fees.

In Georgia, executors work with or without pay, depending on the decedent’s will. Those who do receive compensation are paid out of the probate estate.

Some wills declare how much to pay their executor of estate; others do not.

If the deceased person doesn’t mention any compensation in their will, then the executor will be paid per Georgia’s state law.

On the other hand, if the will explicitly states that the executor of the estate will serve without compensation, they may not receive any payment.

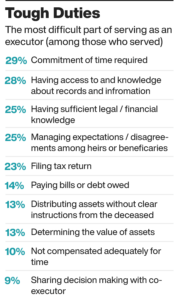

What Can Cause Problems for an Executor of the Estate?

1. Interim distribution

Interim distribution is allocating assets to heirs or beneficiaries even when outstanding creditors still have to be paid, or there is remaining property to sell.

Although Georgia law technically allows this, it carries a HUGE risk.

If the distribution leaves the estate with insufficient assets to cover creditor claims, you, as the personal representative, and the recipients can become liable. None of you are exempt, even if you did not know about the creditor until after the distribution.

You can be obliged to pay the full claim, while the recipients can be accountable for up to the total amount they received.

If you find yourself in this position, you should determine whether the benefit outweighs the risk.

2. Disgruntled beneficiaries

If a beneficiary feels the Executor is not transparent or communicating enough, they have a right to file against them.

3. Inaccurate reports

If the executor of an estate is not keeping a detailed and accurate accounting of the estate, this can cause issues with all the estate stakeholders.

4. Lack of knowledge of Georgia Probate Law

You may think you’re doing the right thing, but if you are paying creditors incorrectly, you can be held personally accountable for settling their claims. Georgia has a creditor priority system you must follow in the proper order.

Can an Executor Decide Who Gets What from the Estate?

An executor of estate must await official confirmation before acting on behalf of the estate.

Being named on the will as a personal representative does not automatically authorize a person to act as executor.

The court must appoint them first legally, or they’ll risk liability for any harm caused to the estate under the legal doctrine of executor de son tort.

An executor de son tort translates to “executor of his own wrong.”

This term refers to a person who wrongfully inter-meddles with or converts the property (assets) of an estate. Doing this in bad faith can make them accountable to the heirs for double the property’s value.

The executor of the estate must follow the terms of the will.

If any heir believes that the executor isn’t acting in their best interest or makes decisions outside of the decedent’s terms, they may file a legal complaint.

There are options to hold the executor accountable, and an experienced Probate lawyer can assist.

- Demand Letter

This document demands a full accounting of the estate assets, liabilities, ongoing bills, and expenses incurred. - File with the court for an Accounting of the estate.

- File a request to remove the executor of the estate

Does an Executor Have to Show Accounting to Beneficiaries?

Once probate has begun, it is natural for beneficiaries to ask about the estate.

Georgia Law requires executors to file an inventory and annual returns with the probate court, but if the will explicitly exempts them, they won’t be obligated to do so.

However, it is pretty common for executors of estate to share informal reports informing beneficiaries of what is happening with the estate.

We generally encourage executors of the estate to provide these because transparency promotes good relationships, and refusing to update beneficiaries can make them suspicious.

If you are the beneficiary, you can file a petition with the probate court requesting the executor to submit a formal accounting.

Once approved, the court may require that the executor file an inventory of the estate.

What Are the Responsibilities of an Executor?

The first thing to understand about the job of an executor of an estate is that they are a fiduciary.

What’s a fiduciary?

A fiduciary is the highest type of relationship that the law understands, which means that a fiduciary has to put their interests below the interests of the beneficiaries or the folks that they’re serving as a fiduciary.

It would be improper, for example, for an executor of an estate to do something or take some action within an estate that would advance their interest at the expense of the interests of one or more of the beneficiaries.

Since the executor is a fiduciary, their duties to the estate are sometimes higher than you would think. Some key things that an executor should be focused on throughout the process.

Honoring the wishes of the decedent as stated in the will is their primary responsibility, but an executor’s duties also include:

1. Being fair to the beneficiaries

As an executor, you could breach your fiduciary duty if you single out a beneficiary when distributing the remaining assets.

Regardless of your judgment towards any of them, you must provide them with what they legally own.

2. Gathering and protecting the estate’s assets

The executor should ensure that all assets of the estate are accounted for and secured. These possessions may include bank accounts, investment accounts, real estate or other property, vehicles, jewellery, or other assets.

They will be responsible for establishing an estate bank account to hold the collected funds and should always keep a detailed inventory of the estate to address potential issues. For example, some heirs may not feel compensated reasonably or question their share of assets from the estate.

3. Identifying the creditors of the estate and giving notice.

Once appointed, the executor should run a creditor or debtor ad in the local newspaper to give proper notice that the estate has opened and that creditors may come forward to file a claim.

When creditors submit their claims, the personal representative must pay them according to a creditor priority system in Georgia.

As a rule, all debts must be paid out of the assets before heirs and beneficiaries receive their portion. If you are a creditor and an executor refuses to pay you, here’s what you can do.

4. Distributing according to Georgia law and the will

The executor is responsible for deciding which property to sell and which to keep. Either way, they must treat their beneficiaries equally and follow Georgia law when making decisions.

For example, if the estate has run out of liquid assets and there are still creditors to satisfy, they may have to sell personal property to pay them.

Sometimes, executors get in a situation where there are insufficient assets to make all the distribution, and that’s where things get complicated because there’s a specific order in which it is supposed to be done.

Likewise, for creditors, there’s a specific order that the executor of the estate would need to follow when paying the creditors, especially if there are insufficient assets to do so.

That’s another area where executors often find themselves in trouble.

5. Reporting on the estate when required

When the Probate Court demands the executor to file for a bond, prepare inventories, and prepare annual returns, they must promptly comply.

Depending on the powers given to them by the will or the court, the executor may have to go back and file additional petitions. And request additional permissions from the court to take specific actions, such as selling real estate or other real estate assets.

That’s a very common area where executors come to us for consultation because they’ve done it improperly, and we have to go back and fix it, which always takes longer and costs more money to the estate.

The executor of an estate will have some reporting requirements to beneficiaries, where they need to report on what is in the estate as well.

6. Filing for discharge after all estate affairs are settled

After distributing the beneficiaries’ share, the executor must attempt to be discharged from the estate.

When they submit the proper discharge paperwork and the court accepts it, the executor may receive a liability shield to protect them from a beneficiary, heir, or creditor attempting to file against them in the future.

What an executor cannot do?

Executors have no obligation, in any regard, to make the estate bigger than what it was when it was entrusted to them. So, investing in the stock market is not only unnecessary, it’s potentially a significant problem for an executor.

Loss of principal could adversely affect other aspects of the estate and estate plan – like funding trusts for a spouse and/or children.

Real estate is quite often an accident waiting to happen.

When to sell, and for how much, what should the realtor’s commission be, should improvements be made (and paid for) before selling… and a host of other questions have to be addressed well before the ‘For Sale’ sign goes up.

One beneficiary might be living in the house, while another might want it sold quickly.

Also, note that insurance companies do not like to insure uninhabited houses for very long.

What’s Next?

There can be various nuances to the role of an executor of an estate that you may need to clarify or tasks that you need to fulfil that will require an attorney’s assistance.

We suggest that you don’t do this alone.

If you need specific information from a probate attorney, please download a copy of our Georgia Probate Handbook or contact us at (770) 637-3272 to schedule a consultation.

More information

Disclaimer These websites have not been reviewed by Georgia Probate Law Group and are not endorsed or even recommended by Georgia Probate Law Group. These websites are additional resources that you can use to further your general education on this topic.

Disclaimer: The information above is provided for general information only and should not be considered legal advice. Our probate attorneys provide legal advice to our clients after talking about the specific circumstances of the client’s situation. Our law firm cannot give you legal advice unless we understand your situation by talking with you. Please contact our law office to receive specific information about your situation.