Power of attorney is an important part of lifetime planning. A POA is accepted in all states, but the rules and requirements differ from state to state. However, one of the main concerns is about what happens with the principal’s affairs when he passes away and who has power of attorney after death if there is no will.

Power of Attorney (POA) is a document that gives someone the legal authority to manage another person’s affairs.

The person who grants authority is called the principal. The person who receives the power to act on the principal’s behalf is known as an agent or attorney-in-fact and can be any competent individual, such as a family member or friend.

There are two main types of POA: medical and financial, both giving the agent general or limited powers.

POAs can be divided into several different categories, such as:

By a general POA, you give your agent the legal authority to act for you in all the situations permitted by local law. This includes financial affairs, business, and other legal matters.

It acts as a non-durable Power of Attorney, terminating when the principal becomes incapacitated or dies. Also, the principal can revoke the POA at any time.

A durable POA is a legal document allowing the agent to handle the principal’s financial affairs, business, and legal matters when he cannot make those decisions for himself.

The attorney agent can continue to make decisions for the principal even after he becomes mentally incapacitated, but his authority ends terminated when the principal passes away.

On the other hand, a non-durable POA allows your agent to act on your behalf for a specific event when you can’t present yourself.

It is valid when you are legally competent, meaning you are coherent and able to think for yourself. A non-durable power of attorney takes effect as soon as all documents are signed and ends when:

the principal becomes incapacitated

is revoked by the grantor

at the principal’s death

Depending on the situation, financial POA can be durable or non-durable.

In Georgia, a Medical Power of Attorney is called an Advance Directive for Healthcare. It allows the attorney agent to make healthcare decisions on the principal’s behalf.

These can be:

medication and medical treatment

the doctors, clinics, and hospitals to administer your care

end-of-life care

Medical POA can be durable or non-durable.

You can set a springing power of attorney to take effect at a future time or when an event leaves you unable to act on your own behalf – for example, if you are mentally incapacitated or have a physical disability.

This type of POA can be durable or non-durable and covers any affairs you (the principal) wish to assign to the agent.

A limited Power of Attorney is an active legal document for a limited time frame and restricts the agent’s power to particular assets.

He can handle just a specific financial or business affair for the principal. The POA ends once the attorney-in-fact did his job or the time expired.

It is essential to know that the agent has no authority to act on behalf of the principal other than what is assigned to him in the limited power of attorney.

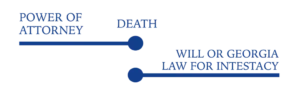

A question that we often receive is, “How long does power of attorney last after death”? It doesn’t.

A durable POA continues even after the principal is incapacitated and ceases when:

the principal passes away.

the principal revokes the POA, provided that the grantor is competent at revocation.

A non-durable POA

ends if the principal becomes incapacitated or passes away.

can be revoked by the principal at any time prior.

A power of attorney expires after the principal’s death. The responsibility for handling his affairs falls on the court-appointed administrator or executor (who must go through probate proceedings).

You should review the will to determine who is named as a personal representative. However, the executor only has legal authority over the property once the probate court formally appoints them.

The first probate phase involves a designated person handling the deceased’s affairs. The named executor must probate the estate and file paperwork to become appointed executor.

To speed up the process, the petitioner must obtain the signatures of the heirs on consent forms

The last step is taking an oath in front of the probate court and swearing to follow Georgia’s laws and the will.

Once the probate court approves the request, the petitioner will receive a court order appointing them to the role and specifying the scope of their power.

As no designated estate administrator exists, an executor is chosen to manage the personal belongings after death without a will.

Under Georgia law, when the person passes away, the power of attorney immediately ends, with or without a will.

No, the executor (or administrator) will take over the deceased person’s estate after being formally appointed by the probate court.

A power of attorney allows an individual to manage the principal’s financial and healthcare affairs while that person is still alive. Under Georgia law, when the person passes away, the power of attorney immediately ends, with or without a will.

Instead, a personal representative will take over the property after the probate court appoints him.

In Georgia, it wouldn’t make a difference if there was or not a POA when someone passes away because a power of attorney would terminate at the time of passing. Instead, an administrator or executor must be appointed to manage the deceased estate.

As the POA ceases on the principal’s death, this would make no difference to the surviving spouse.

It is beneficial to consider having a durable power of attorney for the other spouse during your lifetime in case something happens and you are unable to manage your financial affairs.

The surviving spouse should initiate the probate process to appoint a personal representative to handle the estate affairs of the deceased.

The POA is not valid after the principal’s death, so the abuse happens when someone appointed to act on behalf of the deceased person misuses their authority.

Abuse of POA can happen in transactions that occurred before the principal’s death.

When you discover that your agent has violated the power of attorney, the first step is to consider objecting to that person becoming the estate administrator.

In this case, it begins a legal proceeding called a discovery process – where both parties must share all important information, such as financial data, emails, and other communications. These documents will help determine whether the agent has breached their fiduciary duty.

When you object to an appointment, you can stop further actions that could harm the inheritance by avoiding problems or mistakes that arise while legal proceedings are ongoing.

When a loved one passes away, you also need to handle his financial situation as part of the estate. Generally, a bank will only give information about a deceased person’s financial accounts to those with a legal right to access them.

Typically, there are two situations:

In this case, the financial institution will only inform the individual the probate court appoints as the personal representative over the estate. So, you must start the probate process to become a designated executor or administrator of the property.

Non-probate assets have a designated beneficiary listed to receive them if the account holder passes away. So, if you are the beneficiary on the deceased’s bank accounts or a joint account holder, the bank should give you access to the funds without going through the probate process. You need to fill out the required paperwork, and once they are processed, the bank will release the funds to you.

For more information about this and other probate topics, please get in touch with our law office at (770) 796-4582 to set up a consultation to receive information about your specific situation.

Disclaimer: The information above is provided for general information only and should not be considered legal advice. Our probate attorneys provide legal advice to our clients after talking about the specific circumstances of the client’s situation. Our law firm cannot give you legal advice unless we understand your situation by talking with you. Please contact our law office to receive specific information about your situation.

Compassionate listeners, knowledgeable guidance. Schedule a free consultation with our experienced attorneys and let us help you and your family with your legal concerns.

GET IN TOUCH 770-796-4685Learn Important Probate Essentials, including key things that go wrong in an estate, how to prevent them, and what to do if they happen.

© 2024 Georgia Probate Law Group by Broel Law, LLC. All rights reserved.